The Pakistan Stock Exchange (PSX) experienced a notable downturn as bearish sentiment gripped the market, resulting in the benchmark KSE-100 index plummeting by almost 2,200 points during intraday trading. This decline followed last week’s delay in the announcement of election results by the ECP and concerns raised regarding the resolution of the circular debt management plan.

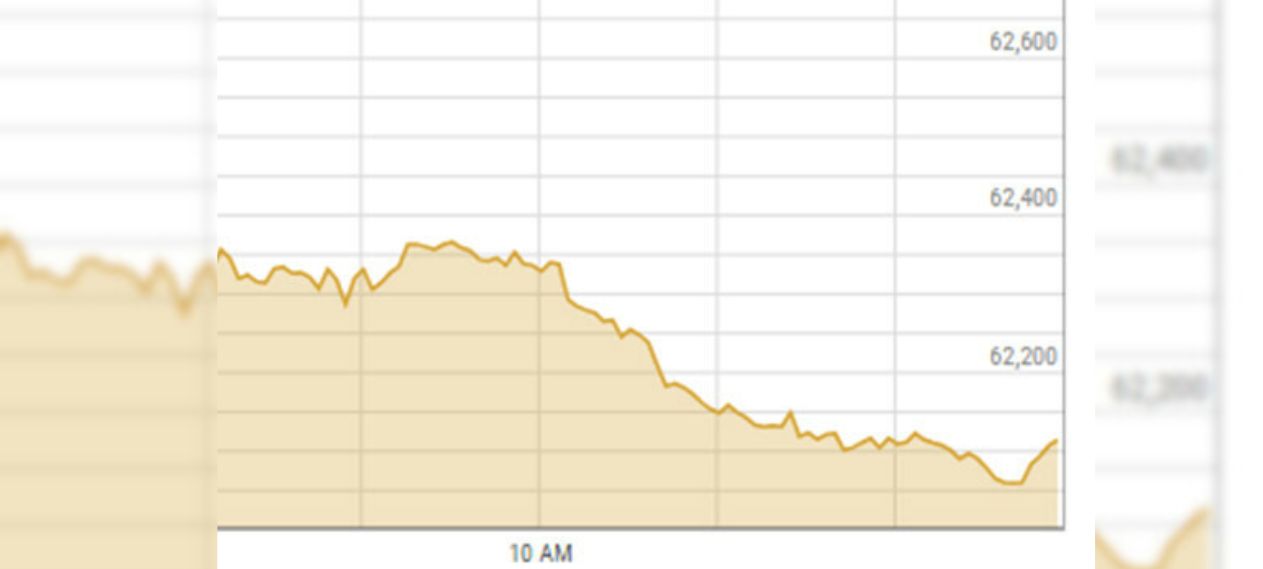

In the beginning, the KSE-100 index opened on a bearish note and immediately entered negative territory, shedding over 1,200 points when trading resumed on Monday. Starting at 62,943 points, the index tumbled to 61,795 by 11 AM and further dropped to 61,740 at 11:05 AM, marking a decrease of 1.91 percent, or 1,203 points.

By 2:55 PM, the index had fallen to 60,650, down by 3.6 percent, or 2,292 points, before settling at 61,065, reflecting a decline of 2.98 percent, or 1,878 points.

Apart from the electoral uncertainty from the previous week, investors refrained from entering the equity market amid reports that the International Monetary Fund had yet to approve Pakistan’s plans for reducing circular debt and rationalizing tariffs. Furthermore, concerns arose over the potential formation of a coalition government, which unsettled a significant portion of investors.

Khurram Shehzad, CEO of Alpha Beta Core, noted that unlike previous election cycles, the KSE-100 index saw consecutive declines in the aftermath of elections, resulting in a substantial erosion of market value. Over two trading sessions, the market capitalization witnessed a collective decrease of PKR 427 billion ($1.53 billion), with each session registering a loss of PKR 214 billion ($767 million).

Also Read : Election Results: PTI-Backed Independent Candidates Leading the Polls

Traditionally, the PSX had shown a positive response post-elections, with market indices rising by 2-3 percent in the first two days following previous elections in 2008, 2013, and 2018. However, this time, the market experienced a 4.7 percent decline post-elections, indicating a departure from historical trends.

The prevailing trend suggests a further decline in investor confidence, although a decisive announcement by the winning political parties regarding the economic team and a clear plan to address economic challenges could potentially trigger a rapid market recovery.

Notably, significant selling pressure was observed in the energy and power sectors, with K-Electric Limited (PSX: KEL), OGDC, and PPL emerging as top losers based on trading volumes. K-Electric Limited saw the highest participation with over 50.3 million shares traded, followed by Worldcall Telecom Limited (PSX: WTL) and Oil & Gas Development Company Limited (PSX: OGDC), with 34.6 million and 14.9 million shares traded, respectively.

Pre-Election Optimism

On the eve of the election, the PSX witnessed a significant upswing. The KSE-100 Index climbed by 345 points, closing at 64,143.87, marking a 0.54% increase.

This rally was fueled by late-session buying as investors engaged in value buying driven by election optimism.

Sectors such as power generation and distribution, commercial banks, and fertilizers contributed to this upward movement.

The oil and gas sector also experienced robust gains in the preceding days.

Also Read: No Internet On Election Day

Election Results Impact

As the election results started coming in, the PSX faced uncertainty due to the tight race.

The benchmark KSE-100 index fell 1,700 points in early morning trade on the day of the election results.

Key Takeaways

- Bearish sentiment gripped the market, leading to a significant downturn.

- The KSE-100 index plummeted by almost 2,200 points during intraday trading.

- This decline followed a delay in election results and concerns about circular debt management.

- Investors refrained from entering the market due to uncertainty and IMF approval delays.

- The market experienced a 4.7% decline post-elections, unlike previous cycles.